Forex Today: Calm continues, Powell pressured, Bitcoin on the rear foot once more

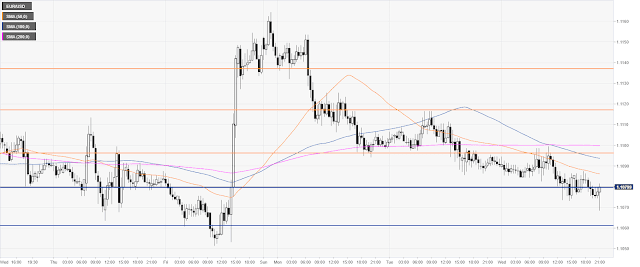

Markets stay calm because the wait toward Fed Chair Doctor Powell's speech on weekday continues. President Donald Trump known as the Fed to slash rates by 100bp and introduce QE, whereas state capital Fed President Eric Rosengren desires to attend and see. - China marginally weakened the yuan – inside expectations. city leader Carrie Lam offered protesters a national dialogue as tensions wane. - Australia: The Federal Reserve Bank of Australia's meeting minutes perennial constant messages, speech that a weaker AUD supports exports and touristry. AUD/USD is marginally higher. - UK: Prime minister Boris Johnson offered to refrain from fitting customs controls in European country if the EU will constant within the Republic of eire. European Council President Donald Tusk rejected Johnson's request to renegotiate the Irish Backstop. - Italy: PM Giuseppe Conte can face lawmakers nowadays and will resign when coalition partners The League and therefore the 5...