Forex Today: Safe-havens fall amid higher risk tone, target trade, Brexit part 2

The metallic element session conjointly remains a thin-showing, with no relevant first-tier macro information due on the cards. Therefore, the speeches by the FOMC members Barkin and Daly are closely one-eyed for recent dollar trades.

Markets can still be careful for recent USA-China trade headlines and also the US President Trump’s comments among Brexit and Italian political developments for near-term commercialism directives.

EUR/USD remains below one.11 despite USA curve inversion, slide in US-German yield unfold

EUR/USD remains on the defensive below one.11 previous the London open despite the USA yield curve inversion and also the slide within the US-German yield unfold to very cheap level since the primary quarter of 2018.

GBP/USD remains subdued previous Brexit talks at Belgian capital

UK’s political uncertainty drags the GBP/USD from the monthly high. British politicians ar active to defy no-deal Brexit, expected proroguing of the Parliaments. All eyes on David Frost’s visit to Belgian capital.

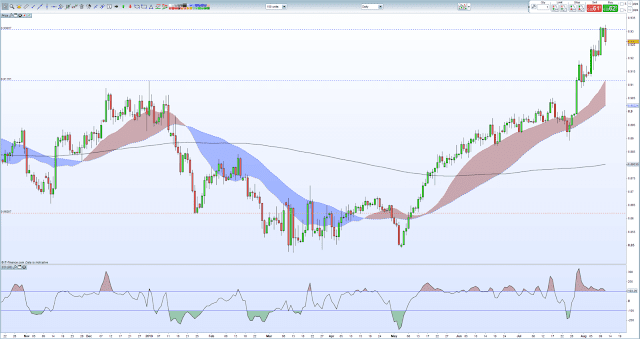

WTI: appearance north with falling channel jailbreak on the daily chart

WTI oil is trying north with falling channel jailbreak on the daily chart. an occasion on top of $56 can be seen throughout the day ahead.

Comments

Post a Comment